by admin | Jul 4, 2025 | Portfolio Management

Value at Risk (VaR) is a widely used measure of financial risk that calculates the maximum potential loss a portfolio of assets or a single asset may incur over a specified period with a specified level of confidence. One of the critical assumptions behind VaR is that...

by admin | Jul 4, 2025 | Portfolio Management

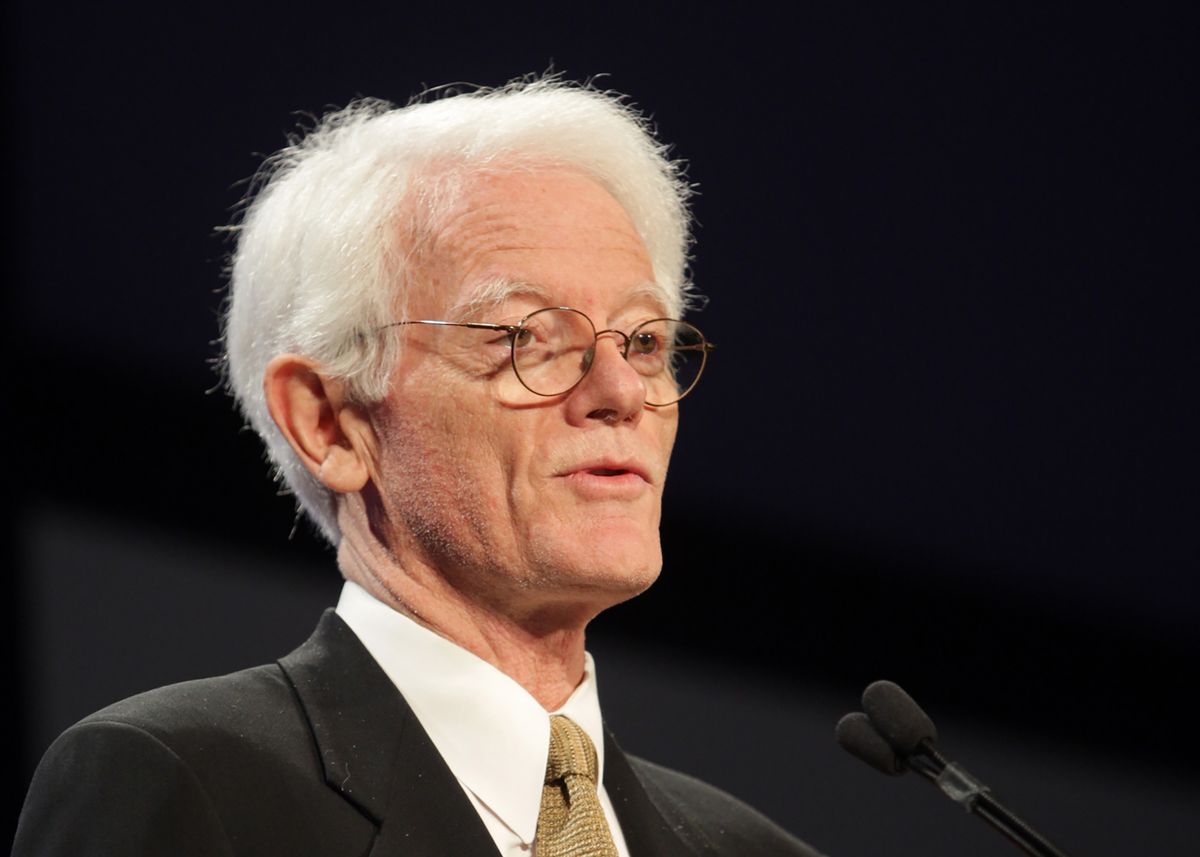

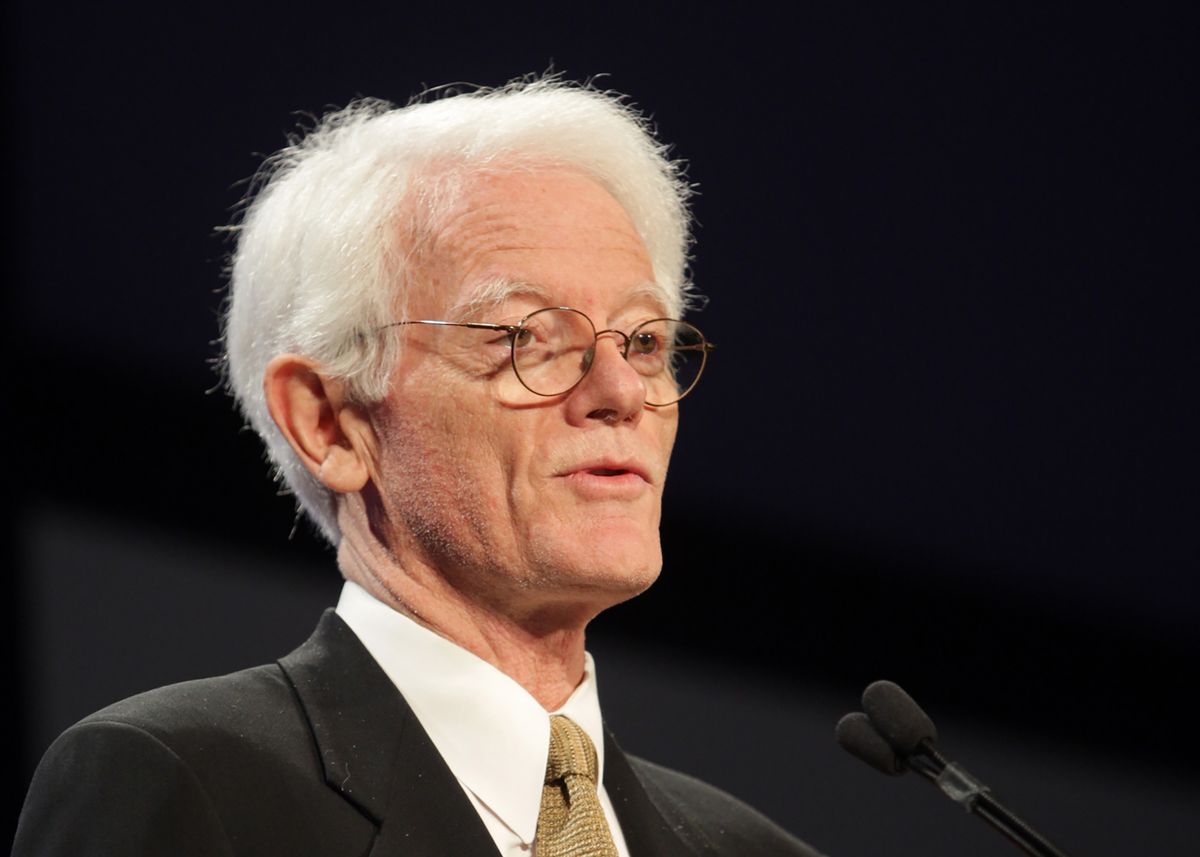

Peter Lynch is a legendary investor who managed the Fidelity Magellan Fund from 1977 to 1990, achieving an average annual return of 29%. He is known for his simple and effective approach to stock picking, which can be summarized in three words: “invest in what...

by admin | Jul 4, 2025 | Portfolio Management

Assets Under Management (AUM) is a commonly used term in the finance industry that refers to the total market value of assets that a financial institution or investment firm manages on behalf of its clients. It’s an important metric used to measure the size and...

by admin | Jul 4, 2025 | Portfolio Management

Dividend investing is a popular strategy among investors who want to generate passive income and grow their portfolios over time. By building a dividend portfolio, investors can receive regular payments from the companies they invest in, while also benefiting from...

by admin | Jul 4, 2025 | Portfolio Management

Warren Buffett, also known as the Oracle of Omaha, is one of the most successful investors in history. With a net worth of over $100 billion, Buffett has become a household name for his long-term investment strategies and the performance of his portfolio. Over the...

by admin | Jul 4, 2025 | Portfolio Management

Investors and financial professionals use the time-weighted rate of return (TWR) formula to measure the performance of investment portfolios over time. The TWR formula is a valuable tool for evaluating the effectiveness of investment strategies, assessing risk, and...

by admin | Jul 4, 2025 | Portfolio Management

Long-term investments are an essential component of a company’s balance sheet. These investments are assets held by a company for an extended period, typically for more than a year. They are often categorized as non-current assets on the balance sheet and can...

by admin | Jul 4, 2025 | Fundamental Analysis

As an investor, it’s important to have a good understanding of the financial health of a company before making any investment decisions. Two commonly used metrics for assessing a company’s financial health are the EV/EBITDA ratio and the price-to-earnings...

by admin | Jul 4, 2025 | Fundamental Analysis

Market value is a concept that plays an important role in finance and investing. It refers to the current price at which an asset or security can be sold on the open market. In the case of stocks, market value represents the price at which shares of a company are...

by admin | Jul 4, 2025 | Fundamental Analysis

When it comes to investing, there are two main approaches: fundamental analysis and technical analysis. Fundamental analysis involves looking at the underlying financial and economic factors of a company or security to determine its value and potential for growth. In...