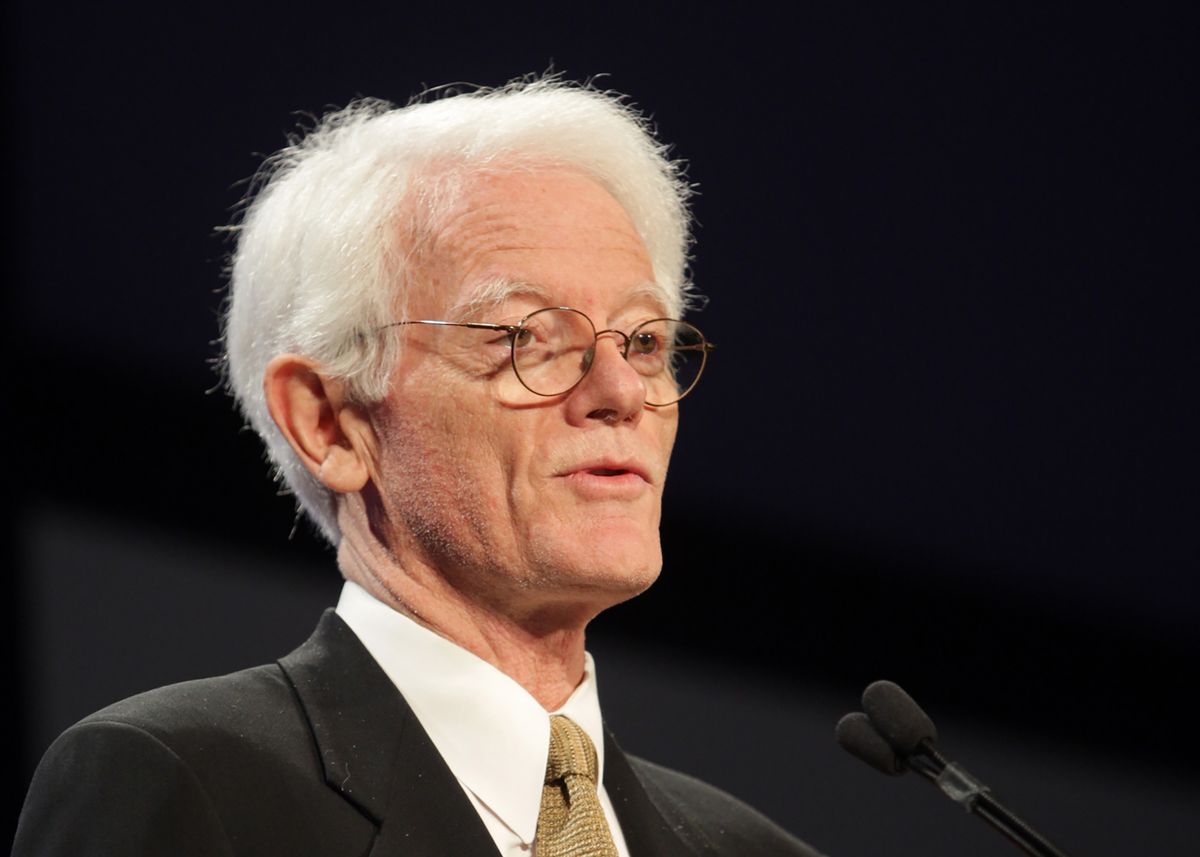

Peter Lynch is a legendary investor who managed the Fidelity Magellan Fund from 1977 to 1990, achieving an average annual return of 29%. He is known for his simple and effective approach to stock picking, which can be summarized in three words: “invest in what you know.” In this article, we will explore the principles of Peter Lynch’s investment strategy and provide tips on how to pick stocks like him.

Principle 1: Invest in what you know

Peter Lynch’s approach to investing was based on the idea that investors can find the best investment opportunities by looking at the companies they know and understand. He believed that ordinary investors have an advantage over Wall Street analysts, who often lack the firsthand experience and knowledge of the companies they cover.

To apply this principle, investors should look for companies that are part of their daily lives, such as the products and services they use, the stores they shop at, or the restaurants they dine in. By focusing on companies that they understand, investors can make informed decisions and avoid investing in businesses they know little about.

Principle 2: Look for companies with a competitive advantage

Peter Lynch believed that the best investments are in companies that have a competitive advantage over their competitors. This could be in the form of a unique product or service, a strong brand, or a low-cost structure. Companies with a competitive advantage are better positioned to generate higher profits and grow their market share over time.

To identify companies with a competitive advantage, investors should look for businesses that have a sustainable and defensible position in their market. This can be assessed by analyzing the company’s financial statements, market share, and industry trends.

Principle 3: Buy stocks at a reasonable price

Peter Lynch also emphasized the importance of buying stocks at a reasonable price. He believed that even the best companies could be poor investments if they were purchased at too high a price. To avoid overpaying for a stock, investors should look at the company’s price-to-earnings ratio (P/E ratio) and compare it to its historical average, as well as the average P/E ratio of its industry peers.

Investors should also consider the company’s growth prospects and earnings potential. A company with strong earnings growth is likely to have a higher P/E ratio than a company with stagnant earnings.

Tips for picking stocks like Peter Lynch

- Do your homework

Before investing in a company, it’s important to do your homework and research the company’s financial statements, management team, industry trends, and competitive landscape. This will help you make informed investment decisions and avoid investing in companies that are unlikely to perform well.

- Focus on long-term growth

Peter Lynch believed in investing for the long term and holding onto stocks that have strong growth potential. This means focusing on companies that are likely to grow their earnings and market share over time, rather than short-term trends or fads.

- Diversify your portfolio

Peter Lynch also believed in diversifying your portfolio across a range of industries and companies. This can help reduce your overall risk and exposure to any one particular company or sector.

- Stay patient

Investing is a long-term game, and it’s important to stay patient and disciplined in your approach. This means avoiding the temptation to buy and sell stocks based on short-term market fluctuations or news events.

- Learn from your mistakes

Even the best investors make mistakes. It’s important to learn from your mistakes and use them as opportunities to improve your investment strategy.

Conclusion

Peter Lynch’s investment strategy is based on the idea of investing in what you know, looking for companies with a competitive advantage, and buying stocks at a reasonable price. By following these principles and doing your homework, you can pick stocks like Peter Lynch and build a successful investment portfolio.