by admin | Jul 1, 2025 | Risk Management

When it comes to investing and finance, there are many types of risks to consider. Two common types of risk are systemic risk and systematic risk. While these terms sound similar, they have different meanings and implications for investors. In this article, we will...

by admin | Jul 1, 2025 | Risk Management

When investing or trading, there is always a risk that the other party involved in the transaction may fail to fulfill their obligations. This risk is known as counterparty risk. Counterparty risk can have a significant impact on investment returns and is an essential...

by admin | Jul 1, 2025 | Risk Management

Investing is an excellent way to grow your wealth and achieve your financial goals. However, not all investments are created equal. Some investments carry a high degree of risk, while others are relatively low-risk. Understanding the difference between low-risk and...

by admin | Jul 1, 2025 | Risk Management

Diversification is one of the most important concepts in investing. It refers to the practice of spreading your investments across a variety of asset classes, industries, and geographical regions to minimize risk and maximize returns. The idea behind diversification...

by admin | Jul 1, 2025 | Risk Management

Climate change is one of the most significant challenges faced by our planet today. It is a global issue that requires urgent attention and action from all sectors, including the finance industry. The Task Force on Climate-Related Financial Disclosures (TCFD) was...

by admin | Jul 1, 2025 | Technical Analysis

Relative strength is a concept widely used in investing and stock analysis. It refers to the comparison of the performance of one stock or investment against the performance of the broader market or a benchmark. The relative strength of a stock or investment can help...

by admin | Jul 1, 2025 | Technical Analysis

Candlestick charting is one of the most popular methods used in technical analysis. The technique originated in Japan in the 1700s and has since been widely adopted by traders worldwide. Candlestick charts provide a more visual representation of price movements...

by admin | Jul 1, 2025 | Technical Analysis

Exchange-traded funds (ETFs) have become increasingly popular among investors due to their low cost, flexibility, and easy accessibility. One such ETF is the iPath S&P 500 VIX Futures (VXX), which aims to track the performance of the CBOE Volatility Index (VIX) by...

by admin | Jul 1, 2025 | Technical Analysis

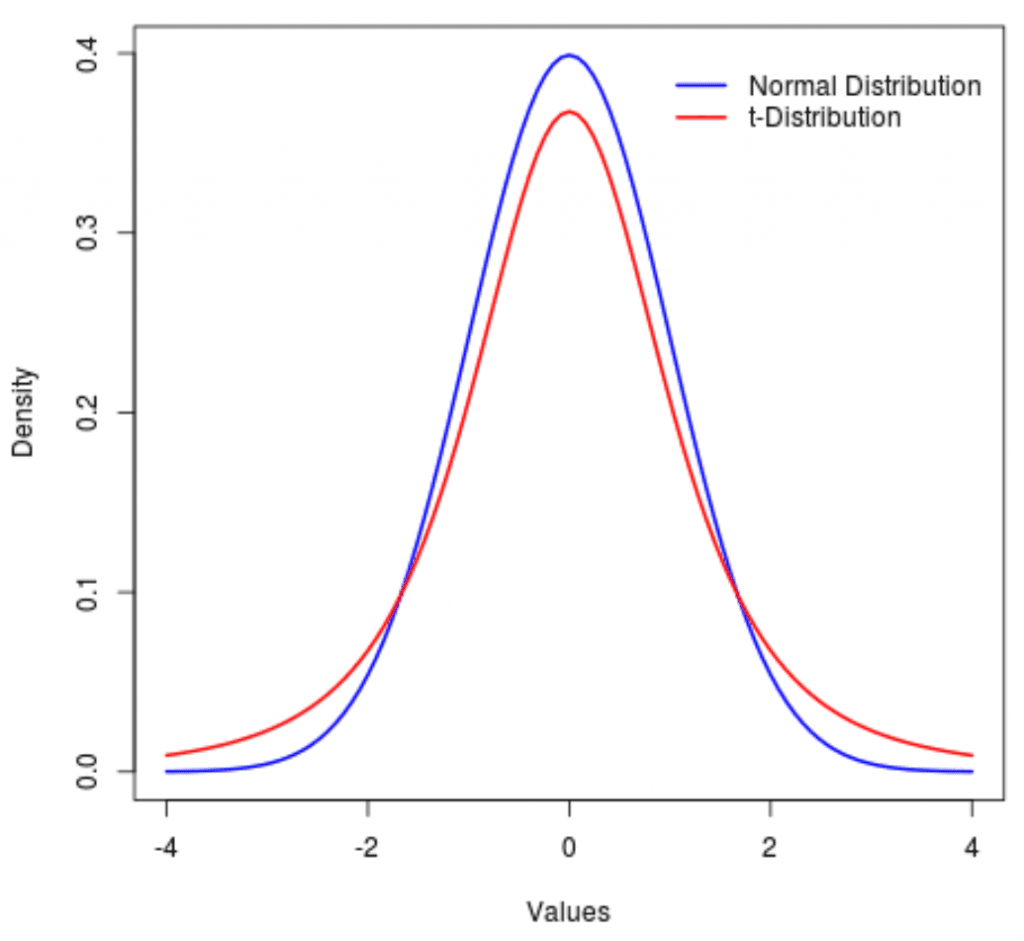

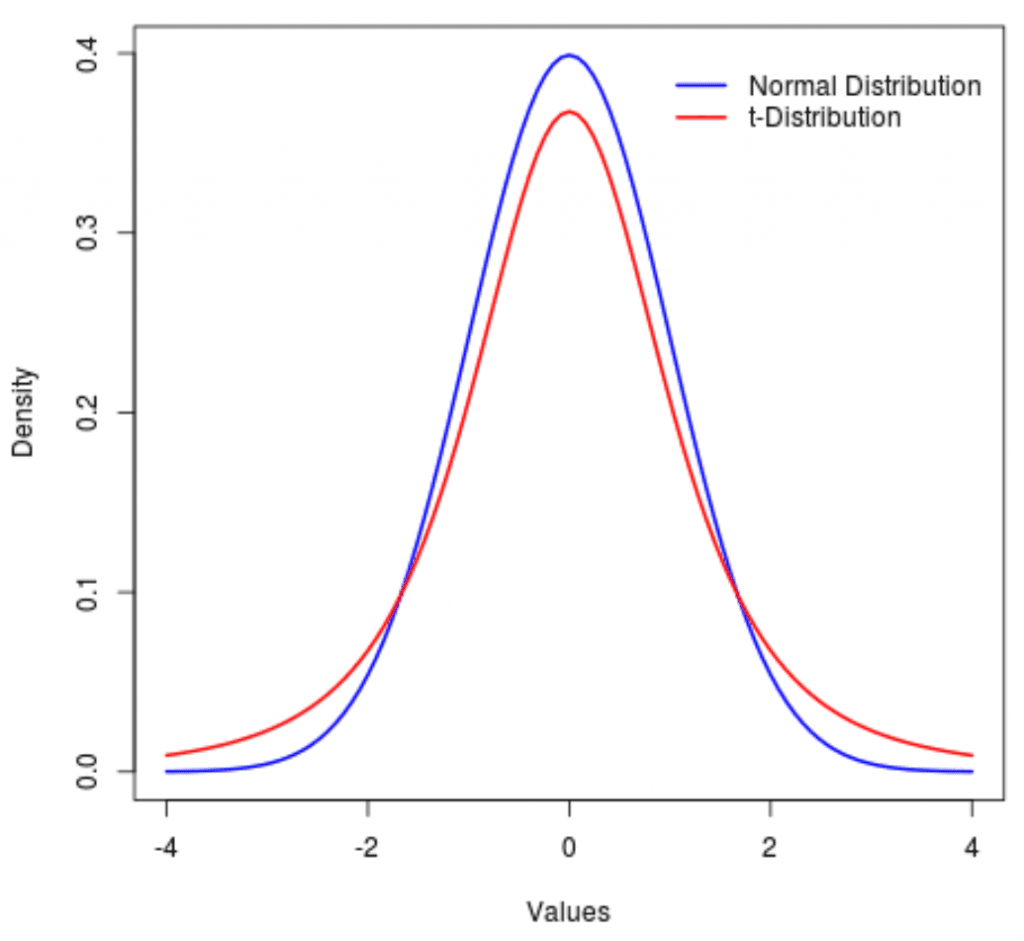

The t-distribution is a type of probability distribution used in statistics to estimate population parameters when the sample size is small or when the population standard deviation is unknown. It is a widely used distribution in hypothesis testing, confidence...

by admin | Jul 1, 2025 | Technical Analysis

Technical analysis is an approach used by traders to evaluate securities by analyzing statistics generated by market activity, such as past prices and volume. Momentum is a critical component of technical analysis, and traders use various technical tools to measure...