Initial Public Offerings (IPOs) have always been seen as one of the most attractive financial investments around and, considering the sums of money many companies have been able to make by offering them, it easy to understand why.

Alphabet, the parent company of Google, managed to boost its shares by 180% in the 12 months following its IPO. Facebook was another IPO success. Although the IPO didn’t take off straight away, it now stands 7 times higher than its initial offering.

IPOs are a fantastic way for companies to make initial offerings, and as such have exciting earning potential. In recent times, Square (SQ) has seen its IPO grow by 1,400%, Roku (ROKU) has increased by more than 1,000%, Twilio (TWLO) by 1,100% at its peak, Zoom Video (ZM) by more than 600%, and DocuSign (DOCU) by 580%.

But few come much better than Shopify’s (SHOP) IPO which achieved an incredible growth in value of a whopping 6,600% following its offering.

IPOs are one of the leading examples of why America is so-often the birthplace for so many innovative and ambitious companies. As entrepreneurs bring new products and stocks to the market, ambitious investors are willing to spend big in order to achieve big profits and help grow their businesses.

It’s why you may also have heard the term ‘SPAC’. This stands for special purpose acquisition company, and it’s quickly becoming one of the key buzzwords in financial circles.

SPACs are behind some of the biggest stock market winners in the last 12 months, and this is primarily because these companies are a fantastic way of taking a private company public and allowing them to access financial markets. With the amount of hype these companies have been generating, they’re fast becoming the subject of intense speculation and interest.

If you’re not yet sure what a SPAC is, we’ve got all the bases covered, so let us break it down: What exactly is a SPAC?

So what is a SPAC?

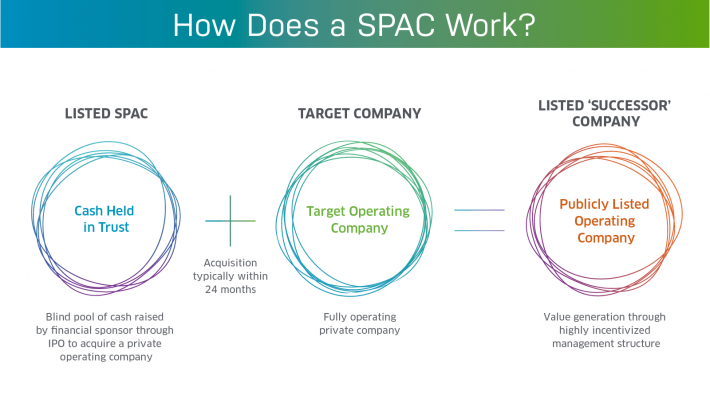

SPACs begin life in a slightly different way than most other companies do. Firstly, these companies don’t actually do business or trade in any kind of commercial capacity on their own. These corporations exist for one main reason: Acquiring an existing company.

As an acquisition company, SPACs are normally first offered as an IPO. They raise funds and attract investment from entrepreneurs on the basis that these companies will make astute investment decisions. Rather than some kind of growth plan, these companies outline a broad strategy for how they intend to deploy the capital raised in their IPO. You might hear SPACs called ‘blank cheque companies’ for this very reason.

So you can see that SPACs operate slightly differently to other companies. They are specially designed to do so, after all. Once a SPAC has found the right investment with plenty of room for handsome growth and profitability, it will then facilitate the IPO of the company, allowing it to overcome some of the riskier aspects of an IPO offering. These are normally:

- Timing: Nobody can stop the stock market from rising or falling. If it does the latter, the hard work and effort of preparing the IPO will have been wasted.

- Uncertain Pricing: Even after a public offering, there’s no guarantee the owner of a private company will receive an attractive valuation for their firm.

- Less Stable Investor Base: IPOs can often attract investors who think a stock has great upside potential. While they may well inject a much-needed cash injection, this doesn’t mean they’ll be in it for the long term.

- Expensive: Very simply, an IPO can fail, regardless of how much time and effort was put into preparing the offering.

SPACs will more often than not feature investors with particular expertise in their sector, allowing them to gain trust from their backers. Literally. The money raised by a SPACs IPO will be placed into a trust account that pays out interest.

Typically, the SPAC will then be given two years to make an acquisition, or to hand back the investment to their backers. Featuring experts in their field, SPACs will often be afforded more patience in completing an acquisition than a different acquisition firm might.

By playing a slightly longer game, SPACs have been growing in popularity in recent years. SPAC IPOs raised $13.6 billion in 2019 on 59 deals, up dramatically from the $3.5 billion raised in 2016 on just 13 deals.

In 2020 alone, there have been 182 SPACs who have managed to raise $65.7 billion. In a year of instability and chaos, the appeal of a SPAC is clear to see.

SPACs have been growing in popularity, but also in size. The largest SPAC in the world, Pershing Square Tontine Holdings (PSTH), made its first IPO last July to much acclaim. On the offering, Barron’s wrote, “new SPAC issuance is soaring, with multiple initial public offerings a week for several weeks running”.

We expect SPACs to grow dramatically in the future, and that’s why we’re bringing two of our favorite SPAC suggestions to you. Exciting things are happening with these special purpose acquisition companies and if you’re looking for some of these companies to watch, here’s what we’d recommend.

Two SPACs to watch

Fortress Value Acquisition Corp. (FVAC) raised $300 million in its IPO. Within months, it had already announced a merger with MP Materials, meaning the company now trades on the New York Stock Exchange as MP Materials Corp (MP).

MP Materials is the proprietor of Mountain Pass, the only rare earth mining site in North America. From this facility, Mountain Pass refine the key materials used for powering electric vehicles, wind turbines, robotics, drones and defense systems.

The rare minerals market is dominated by Chinese firms, so it goes without saying Mountain Pass’ importance is as strategic as it is financial. As some companies look to reorient their supply chains away from Chinese companies, Mountain Pass has been positioned as a leading alternative for rare earth mining.

In its IPO, Fortress was able to attract some notable investors. Even one of the earliest investors in Facebook was drawn to its IPO. It may seem counter-intuitive that investors are looking to invest in rare-earth mining, just as many countries are shifting to renewable and electric energy, but many investors believe that demand for rare-earth minerals could actually be a boost for electric energy. Rare-earth minerals could be to electric energy what Intel was to the PC boom – a common component in every solution.

The merger with Fortress came at an opportune time. The mining industry brings with it substantial barriers to entry; permits are difficult to obtain and maintaining mining operations can be costly. So with additional sources of revenue, MP has consolidated an already very strong position. Even before the merger, MP was already an exciting long-term investment.

Another SPAC that went broadly undocumented was Graf Industrial Corp. (GRAF). In its IPO, GRAF raised over $250 million, and in early July merged with Velodyne Lidar (VLDR). Where VLDR differs from GRAF though, is its heavy involvement in autonomous vehicles – a rapidly growing sector.

LiDAR was first used in the 1960s, LiDAR technology determines distance from an object and then calculates the distance. Over millions of sensory detection, LiDAR is able to create a 3D map of the surrounding environment. An onboard computer can then use this map to safely navigate. LiDAR has seen expanded its function to be used in industries like trucking, drones, mapping, robotics and security.

Velodyne first began developing this technology in 2005, and provides this technology to more than 300 customers in the global automotive sector. The company has also been seeing exciting growth over the last year. These contracts typically last around five years and are therefore a recurring revenue stream.

In light of this, Velodyne believes it has a cumulative revenue opportunity of $7 billion between 2020 and 2025.

The autonomous vehicle sector is a young but exciting sector, and is something we believe can grow substantially in the future. All major vehicle manufacturers are producing autonomous vehicles, and as 5G arrives to make these vehicles more feasible, we think this SPAC could well be one to watch.

The future of SPACS

SPACs have been growing in size and wealth for some time but remain somewhat underpublicized. We think this makes now the perfect time to invest in a special purpose acquisition vehicle.

IPOs are well-documented, but so too are the lop-sided benefits that they bring to Wall Street firms, rather than their investors. We think the traditional pipeline that brings private companies public through an IPO is broken. That’s why we, and many other investors, are turning to SPACs.

In the next few years, IPOs will most likely become something from a bygone age. If you’re looking to keep up to date with the most innovative and disruptive ways of taking a private company public, you need to keep your eyes on SPACs.