Brought to you by ![]()

Claim Your Flagship Membership to Power Phase Investor!

Fellow Investor,

Imagine what it would be like to pay off your house . . . retire early . . . or have a couple extra million in your pocket.

For many investors this is only a dream . . . perhaps something to envy but not entirely feasible.

For those who know the secret of investing in companies during the power phase of their growth . . . however . . . this is more than just a thought . . .

It’s a way of life . . . that flows huge earnings into the pockets of an elite group of people who continuously watch small companies become big equity masters.

So what am I talking about?

I’m talking about becoming one of the people who cash in on the early and powerful growth phase of relatively unknown companies . . .

Companies like Plug Power Inc, powering the driverless revolution . . . which could have made you a gain of 1,615% in less than a year . . .

From 2020 to 2021, that could have turned every $1000 invested into $16,150.

And that’s just one year with a power phase company.

Imagine . . . over ten years with a company like Tesla . . . you could have made over 17,500%. That means every $5,000 you invested would have turned into $877,500.

But we’re not talking about investment opportunities that have come and gone. We’re talking about the here and now. . .

Stocks that no one’s talking about yet.

These are stocks that are at the basement level but can and will climb to the roof.

Like NIO . . .which also took a profitable gain of 1,538% in less than a year from 2020 to 2021. . . turning every $1,000 into $15,380.

And you only need to know one too . . . to begin seeing a build-up of massive money in power phase companies. That’s why it’s crucial you start to think about the companies we offer through this service from the standpoint of an “angel investor.”

What are angel investors?

And how do they make enormous gains through multiple years on power phase companies?

Angel investors are venture capitalists that support start-up companies as they grow into efficient, money-making giants.

If you’ve seen the show Shark Tank that’s who they are. They are the ones who look to make the slam dunk wins in the investing world. They don’t look to make a 500% return on the companies they invest in. Within multiple years, they are thinking of returns in the 2,000%… even 20,000%.

And all they have to do is be right once. Then they never have to worry about money again. Remember that scene in the Social Network when Mark Zuckerberg goes to meet potential investors in his pajamas? Those were the guys. And obviously it didn’t matter what Mark Zuckerberg wore. What mattered was at the time Facebook was a power phase company that they knew was going to give them enormous returns.

For every Uber, WhatsApp, Airbnb, Tesla, or Google there was an angel investor. And this is way before the public even knew about them. How did these big investors do it and make mind-blowing profits? By doing the research, having the foresight to make an early investment, and sticking through.

For those interested in what our services do . . . however . . . this is all done for you . . . but more of that in a second . . .

Because I want to tell you something . . .

By the time anyone usually hears about these companies—like the mass majority of market investors—angel investors will have already profited amazingly. Take early Tesla investors, DBL Partners, who put $400 million in a venture capital fund supporting Tesla and others. Even if they only put 20% of that in Tesla. They would now be sitting on $14 billion.

And while we’re not recommending non-public companies in our Power Phase Investor research service, we will use the mindset of angel investors and venture capitalists.

We do this to profit off the new Whatsapps, Ubers, and Googles. And our goal is straightforward: we want to help our investors make hundreds or even thousands of percent returns with the current economy’s best power phase public companies.

The Secret of Power Phase Investing Portfolios

For most investors, a winning rate less than 50% is a no-no. Their stock picks must be right 75% or 85% of the time. If not, their gains will just be mediocre.

The secret most angel investors and venture capitalists won’t tell you though is that this mindset is completely irrelevant to power phase investing. Because with a winning strategy, you can be right 10% and still make the biggest gains of your life.

For example, you could have 9 small losses and one huge win . . . and still be an OUTSTANDING WINNER.

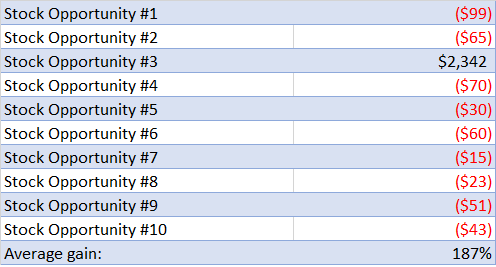

Hypothetically speaking, let’s say on January 1st, you make a portfolio of 10 hopeful businesses with promising chances of success. You put $100 in each one of them without touching them for a year.

Let’s say those 10 stocks look more or less like this at the end of the year:

As you can see most of them failed . . . 9 out of 10 were in the RED.

In math class, that means a failing grade. In venture capital terms, you came out a HUGE WINNER.

And that’s all because you won big once . . .

Because of that your average gain was 187%. Much bigger than you could have ever hoped for playing by the boring and predictable rules that get you a 3-4% return.

In addition, the most you could have lost with each stock was $100.

Now, imagine you are right 50% or 75% of the time with this strategy—you are looking at returns of 500%, 1,500%, 2,500% . . . or more!

This is because power phase stocks are among the most volatile in the market. They are risky and are more likely to fail than your average safe, blue-chip stock like 3M or Johnson & Johnson. But that’s why end payouts are so huge and unlike anything you can make predictably.

In short, it’s a different sort of game . . . and because of it, you must understand how the most successful angel investors manage their investments.

Because power phase companies can produce such gigantic capital gains and have higher failure rates than established companies – it’s vital to understand a key money management principle used by the best most successful angel investors.

Like I said though you can be right a mere 10% of the time and still be an OUTSTANDING WINNER.

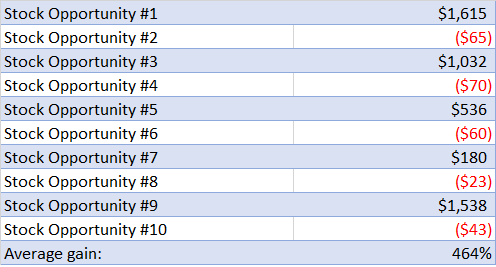

So what’s it like when you win—say 50% of the time . . .

Let’s say now you invested in companies like Plug Power Inc, NIO, Shopify, and Square who saw respective gains of 1,615%, 1,538%, 180%, 536% in less than a year.

Here 5 won . . . and 5 lost . . .

Your average gain was 464% . . . much better than when you won 10% of the time . . .

But still, that’s not what you’d expect . . . and that’s why you need to have a mentality shift…

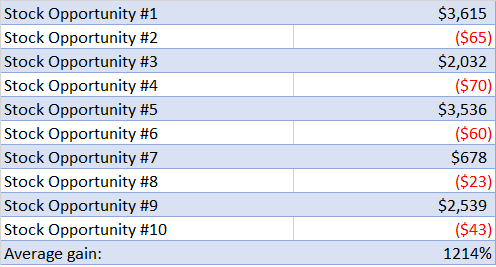

And if that’s over one year . . . now think over multiple years . . . those same companies could look like this . . .

Yes, your money was long gone with 5 of them, but the good five . . .

With them you are looking at returns of 1,214%!

And their potential is to keep on growing . . .

There’s one thing to remember though. The best angel investors know that they have to bite the bullet and lose sometimes in order to profit tremendously from the wins.

Also, we’re not looking to win 10% or 50% of the time . . . we are looking to win over 50% every time with the cream of power phase companies . . .

Since the late 90s, Fred Wilson has made billions off of investing companies like Twitter, Foursquare, Tumblr, Indeed, Kickstarter, and Etsy. Using the angel investor model, he has seen returns of $14.2 billion (Twitter), $1.4 billion (Indeed), and 1.78 billion (Etsy)–just to name a few.

He is the co-founder of Union Square ventures—one of the world’s most prominent tech venture capital firms. But his success isn’t because he is focused on a single niche . . .

It’s because he understands the angel investor mindset, which he sums up in his beliefs:

“I believe it is a fundamental law of [power phase] investing that a small number of investments will produce that vast majority of the returns.”

Wilson didn’t tune in or complain about his losses. Neither did he dwell on them. His focus was on the small number of investments that gave him massive returns. That was the key to his success. And will be the key to yours as well. As he plainly puts it:

“I am not suggesting that a high loss ratio is indicative of good performance. It is not. But it is indicative of risk taking, and importantly, taking your lumps and moving on.”

We get that people want to be winners. We also want to be right on all our investments and never suffer a loss. That’s when we began to ask ourselves a simple question, “Is it better to be right 100% of the time or to make amazing returns and grow rich?” Finally, cooling our emotions we understood. It’s better to be rich.

Once again, winning 100% of the time is unlikely. . . But we do take calculated risks, do extensive research, and are rewarded with big and consistent returns despite the win ratio not being perfect.

And one more thing . . . we are not just giving you some stock picks, but a meticulously put together portfolio comprised of those power phase companies most likely to WIN BIG. Also, this includes all buy prices and sell alerts. So you never get stuck and always know exactly what to do.

In short, we do the work . . . and you make the money.

And the awesome part is when you win and you’re right you make a lot, and if you lose it will only be a small dent.

This Is What You Can Do to Start Today

Power Phase Investor is a portfolio of up-and-coming stocks with the power to change how you live, work, and play.

This includes companies that the talking heads and key financial advisory websites ignore . . . until it’s too late and the price explodes . . . and it becomes obvious to everyone.

In short, these are the ones that are filled with opportunities to make life-changing gains.

. . . Changing small investments of $500, $1000, or $2,000 . . . into $15,000, 25,000, $50,000 or more. . .

But the thing is you need to get in before the herd and sell for a massive profit to those who are late to the party.

As soon as you sign-up, we will give you access to the whole of our portfolio packed with promising stocks invested in businesses such as the driverless revolution, AI, and cutting-edge technologies in finance, manufacturing, science, and medicine.

You’ll also get special access to the Power Phase Investor’s library of the Exclusive Investor Reports that show you the biggest upcoming trends in the market. This is where you can find unicorn companies before they are unleashed to the mainstream media. They will always be ready and available for you to review.

In addition, with your membership every month you’ll get a fresh investment prospect that our analysts have spent weeks and months reviewing.

With technology, science, and the ever-changing world situation, you will have access to the newest investment opportunities that could change the lives of you and your family members forever.

It’s our mission to put those opportunities in front of you before it’s too late.

In short, Power Phase Investor is a unique vehicle for your future success—unlike any cut and dry financial research firm you probably know.

That’s why today we want you to take your chance to claim a one-year Flagship Membership for $2,999.

If you feel you aren’t confident enough to sign up for a full year, you can claim a 13-week introductory membership for just $799.

Think of one thing though . . . the quicker you act, THE MORE MONEY YOUR INVESTMENT WILL BRING.

So, act NOW.